Certificate of Deposits

A certificate of deposit (CD) is a savings product that earns interest on a lump sum for a fixed period of time. CDs differ from savings accounts because the money must remain untouched for the entirety of their term or risk penalty fees or lost interest. CDs usually have higher interest rates than savings accounts as an incentive for lost liquidity.

We’ve Got A Certificate of Deposit That’s Right For You

KeySavings Bank offer CDs, see below for our rates and understand that early withdrawals have a penalty.

- Top-paying certificates of deposit (CDs) pay higher interest rates than the best savings and money market accounts in exchange for leaving the funds on deposit for a fixed period of time.

- CDs are a safer and more conservative investment than stocks and bonds, offering lower opportunity for growth, but with a non-volatile, guaranteed rate of return.

- Although you lock into a term of duration when you open a CD, there are options for exiting early should you encounter an emergency or change of plans.

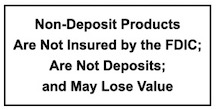

Our Certificates of Deposits offer guaranteed yields, flexibility, and the safety of FDIC insurance for up to $250,000 per individual. That’s because you lock in a high yield that’s guaranteed from the day you open the account until the day it matures. You know exactly what return you’ll get and when you’ll get it.

| Term | Interest Rate % | Annual Percentage Rate % | Minimum amount to open/earn APY% |

|---|---|---|---|

| 91 Day | .20 | .20 | $1,000/$1,000 |

| 182 Day | .25 | .25 | $1,000/$1,000 |

| 8 Month | 1.25 | 1.25 | $1,000/$1,000 |

| 10 Month | 2.50 | 2.51 | $1,000/$1,000 |

| 12 Months | 3.15 | 3.19 | $500/$500 |

| 24 Months | 2.95 | 2.98 | $500/$500 |

| 30 Months | 2.25 | 2.27 | $500/$500 |

| 36 Months | .55 | .55 | $500/$500 |

| 48 Months | .60 | .60 | $1,000/$1,000 |

| 60 Months | 2.25 | 2.27 | $1,000/$1,000 |

| DISCLOSURE | At our discretion, KeySavings Bank may change interest rates on all interest earnings accounts. Fees may reduce the earnings on all interest earning accounts. | A penalty may be imposed for early withdrawal from term accounts | |

| *Eligible for a one time bump up during the certificate term (4 Year ONLY). |

Why so many selections

Our selection of CD’ s allows individuals to select different maturities to match their investment needs. For more complex investments, laddering the maturities may offer a more flexible solution to your investment needs. To discuss these and other options, please contact one of our CD experts.

We offer Certificates of Deposit in a broad range of maturities, each designed with a particular goal in mind. And, for as little as $500, you can open your own CD.